D’un côté, le paiement pour les devoirs peut vous faire gagner du temps précieux. Si vous êtes déjà débordé par payer pour faire mes devoirs d’autres responsabilités, déléguer vos devoirs à quelqu’un d’autre peut vous permettre de vous concentrer sur d’autres tâches importantes de votre vie. Cela peut également vous aider à réduire votre stress et à retrouver un équilibre entre votre vie personnelle et vos études.

Please click on link below for family and benefits details:

https://www.canada.ca/en/services/taxes/child-and-family-benefits.html

Overview of child and family benefits

Provincial and territorial benefits

RC66 – Canada child benefit application

T4114 – Canada Child Benefits and related provincial and territorial programs

RC4210 – GST/HST credit (including related provincial credits and benefits)

RC4064 – Disability-Related Information

Other Benefits: more information on tax and benefits measures

Canada Recovery Benefit (CRB).

Canada Recovery Sickness Benefit (CRSB).

Canada Recovery Caregiving Benefit (CRCB)

Canada Emergency Wage Subsidy (CEWS).

- T5, Statement of Investment Income

- T3, Statement of Trust Income Allocations and Designations

- T5013, Statement of Partnership Income

Tax-free savings account (TFSA) The amount that you can contribute to your TFSA every year has been increased to $6,000 in 2019. Please see further notes, below. Dividend tax credit (DTC) The rate that applies to “other than eligible dividends” has changed for 2016 and later tax years. For more information see lines 120 and 425.

Tax-Free Savings Account (TFSA) Beginning in 2016, Canadian residents 18 years of age and older can each contribute up to $5,500 annually, plus any unused contribution room from previous years, to a tax-free savings account.

- Contributions to a TFSA are not deductible for income tax purposes.

- Interest on money borrowed to invest in a TFSA is not tax deductible.

- Contributions to and income earned in a TFSA are tax-free upon withdrawal.

- You can give money to your spouse for a TFSA contribution, and the income earned on the contributions in your spouse’s TFSA will not be attributed back to you.

- Investment income earned by, and changes in the value of TFSA investments will not affect your TFSA contribution room for the current or future years.

- You will accumulate TFSA contribution room for each year even if you do not file an income tax and benefit return or open a TFSA. The annual TFSA dollar limit for the years 2009, 2010, 2011 and 2012 was $5,000. The annual TFSA dollar limit for the years 2013 and 2014 was $5,500. The annual TFSA dollar limit for the year 2015 was $10,000. The annual TFSA dollar limit for the year 2016, 2017 and 2018 was $5,500. The annual TFSA dollar limit for the year 2019 is $6,000. The TFSA annual room limit will be indexed to inflation and rounded to the nearest $500.

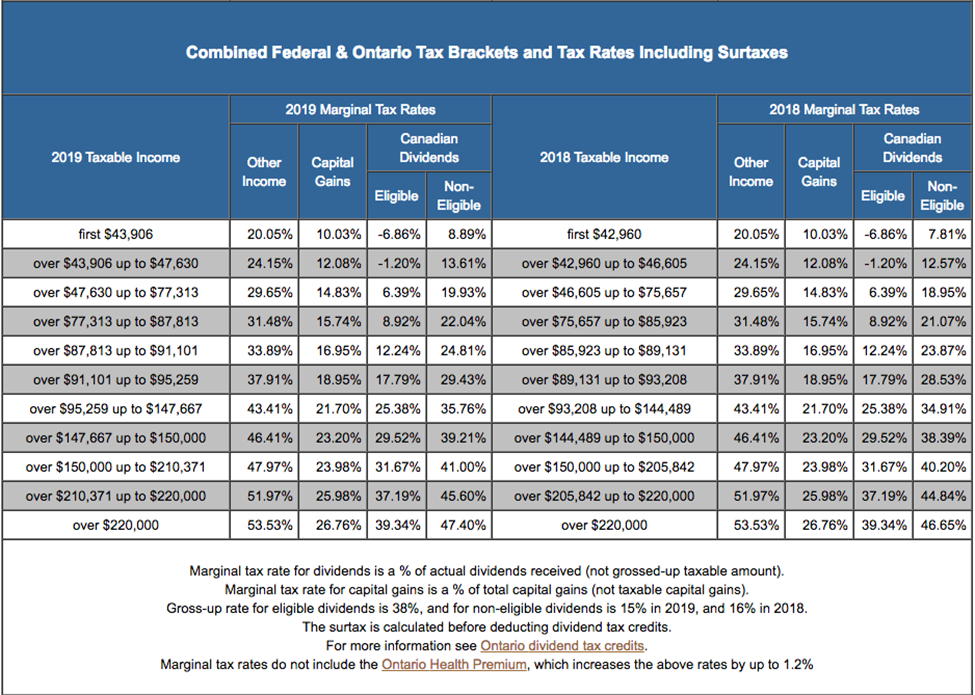

Tax rates are significantly more favourable for dividend income than interest income. The personal tax rates in Ontario for 2019, 2018 and 2017 are as follows:

Re-evaluate your investment strategy by comparing the pre-tax dividend rates with the pre-tax interest rates.

The tax rules associated with the disposition of a principal residence and the eligibility for the principal residence exemption (PRE). The following new rules have been introduced:

- A non-resident will not be eligible for the PRE in respect of the year a property is acquired unless he/she was a resident of Canada in that year.

- Only certain trusts will be eligible to claim the PRE. Many ordinary family trusts holding a principal residence that is inhabited by one or more beneficiaries will have restrictions on the PRE under the new rules. There are transitional rules that will allow such trusts to utilize the PRE on the accrued gain on the property up to December 31, 2016. Any future appreciation in the property would be subject to tax.

- The property can be distributed to one of the beneficiaries (only to the extent he/she ordinarily inhabits it) on a tax-deferred basis. The beneficiary can then sell the property and claim the PRE personally. The transfer of the property from the trust to the beneficiary can occur after December 31, 2016, but the beneficiary must continue to ordinarily inhabit the property if he/she wants to fully shelter the gain with the PRE on a future sale. Note that the trust itself will no longer be eligible to claim any portion of the PRE in respect of gains accrued after December 31, 2016.

- All dispositions of principal residences must be reported on Form T2091, whether or not the gain is sheltered by the PRE. Penalties for non-compliance will apply. Reporting requirements apply for the 2016 and future tax years.

- CRA may reassess a taxpayer’s return beyond the three year normal statutory assessment period when a disposition of a principal residence is not reported