In summary, adapting to business growth can involve embracing more sophisticated accounting practices like accrual accounting. Keep in mind that the choice to use cash basis or accrual basis accounting will impact your business for the foreseeable future. Your business size can be the determining factor in deciding which accounting method to use. Sole proprietors and freelancers almost always decide in favor of the cash basis because it’s simple and more accurately tracks cash flow. Many businesses prefer cash-basis accounting the difference between cash flow and profit for taxes because it can make it easier to maintain enough cash to pay taxes. However, the accrual system may be better for complete accuracy regarding yearly revenue.

What are the main differences between cash basis and accrual basis accounting?

Cash basis accounting is most commonly used in retail businesses that do not have a large volume of transactions. Physicians, consultants, and other professionals that perform services for clients also use cash basis accounting. After implementing an accrual accounting system, your company’s balance sheet will contain significantly more detail about your liabilities and transactions compared to cash basis accounting. Accrual-focused accounting tracks revenue as it is earned and expenses the moment they are incurred.

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- If you use accrual accounting, you’ll need to keep a close eye on cash flow in order to avoid potentially devastating consequences.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

- Please read our review for more information on QuickBooks Online and our ratings for other top accounting software.

- While some business owners are free to choose the type of accounting method they want to use, others aren’t.

Because it offers a more accurate long-term look at your finances, accrual-basis accounting is the right method for most businesses. However, if your business isn’t very complex, you might be able to use the simpler cash accounting method instead. Ultimately, the decision to adopt GAAP and accrual accounting should be based on the unique needs and goals kernersville north carolina tax preparation bookkeeping and planning of each business entity. In addition to accounting software like QuickBooks and FreshBooks, businesses need to maintain a ledger to record financial transactions. Modern accounting software automatically creates ledgers for businesses, saving time and reducing the risk of errors. However, cash basis accounting may not accurately reflect the financial health of a business with more complex operations or liabilities.

While some business owners are free to choose the type of accounting method they want to use, others aren’t. For instance, if you manage inventory or let your customers make purchases on credit, you must use accrual accounting. This can help alleviate any concerns that the entrepreneur or management may have about mistakes or oversight in their financial reporting. Accrual accounting is a method where income and expenses are recorded regardless of whether payments have been received or made.

Cash Basis vs. Accrual Basis: What’s the Difference?

Accounting software and tools have made the implementation of cash and accrual accounting methods easier for businesses. In this section, we will explore some popular accounting software solutions and how they incorporate cash and accrual accounting methods. For example, a small business or small law firm might use the cash basis of accounting for routine transactions such as sales transactions and bill payments. This simplifies the daily bookkeeping and gives a clear picture of cash flow and cash available at any given moment.

When evaluating a company based on exactly when cash is on hand or paid out, it is easier to misconstrue the financial state of a business. The accrual-basis approach forces everything to be accounted for in a timely manner. One of the most significant differences between cash and accrual accounting is that each method affects which tax year your income and expenses are recorded in.

Construction Accounting 101 & 8 Options to Choose From

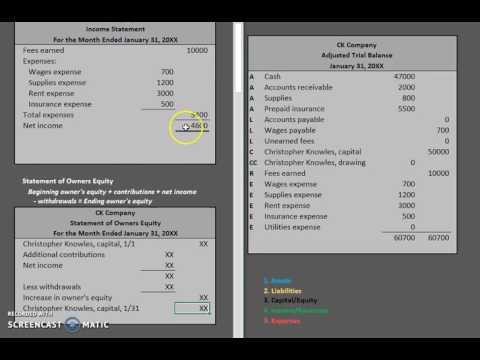

Cash basis accounting records revenue and expenses when actual payments are received or disbursed. On the other hand, accrual accounting records revenue and expenses when those transactions occur and before any money is received or paid out. It’s more accurate, and if you manage inventory, it’s the method the IRS requires you to use. With cash-basis accounting, you won’t record financial transactions until money leaves payroll expenses definition or enters your bank account. With use accrual-basis accounting, you’ll record transactions as soon as you send an invoice or receive a bill, not when the money changes (virtual) hands. Learn the pros and cons of each bookkeeping method below and decide which one is right for you.

This method makes it easy to keep the unique situation of each sale or bill up to date, making adjustments when each item is satisfied or keeping notes of anything still outstanding. To change accounting methods, you need to file Form 3115 to get approval from the IRS. In Quickbooks, you can choose either Cash or Accrual as your accounting method. You can also run reports that use either method, so you can compare how your finances look with each. Let’s say you complete legal work for a client and invoice the client in January, but the client doesn’t pay until March. The income is still recorded in January, even though the client hasn’t yet paid.